What is the Small Business Finance Markets Report?

The British Business Bank’s annual Small Business Finance Markets Report is a comprehensive and impartial assessment of finance markets for smaller UK businesses, acting as a trusted source of information about how they operate and deliver.

This is a summary of key findings and conclusions from the 2025 report, in which we assess the importance of business investment, and the role of access to finance, as well as assessing more recent trends in smaller business finance markets.

About the British Business Bank

The British Business Bank is the UK’s economic development bank. Our mission is to drive sustainable growth and prosperity across the UK, and to enable the transition to a net zero economy, by supporting access to finance for smaller businesses. The British Business Bank delivers a range of both debt and equity programmes, ensuring that small businesses can access finance that is right for their needs at the right time.

Snapshot Summary

- Fewer smaller businesses are using external finance, but value of finance edged up in 2024.

- Business investment is central to improving long-term growth and often requires

finance. - Finance markets are evolving to reach entrepreneurs from different backgrounds

and in more places. - More investment is needed in the UK’s fastest growing and most innovative

companies.

This year’s Small Business Finance Markets report is divided into two sections. Part A is dedicated to the importance of business investment and the role of access to finance. Part B explores recent trends in small business finance markets.

Key findings

1. Fewer smaller businesses are using external finance, but value of finance edged up in 2024.

- The proportion of small businesses using external finance fell from 50% in Q3 2023 to 43% in Q2 2024, where it remained steady in Q3. Despite this decline, total finance flows have held up in nominal terms, suggesting resilience in overall funding availability

- Gross bank lending reached £62 billion in 2024, a 4.5% increase year-on-year. This marks the first time since 2020 that bank lending has outpaced asset finance growth. Challenger banks strengthened their position, accounting for 60% of total bank lending.

- Equity investment volumes in 2024 remained comparable to 2019 and 2020 levels. Deal values rose 7% in the first three quarters of the year, largely due to strong Q2 performance, but investment activity slowed significantly in Q3.

- While total deal values grew, the number of equity deals fell by 24% year-on-year, reflecting a more selective investment landscape. The slowdown in Q3 highlights ongoing challenges in securing SME investment.

2. Business investment is central to improving long-term growth and often requires finance.

- Business investment expands production capacity, improves efficiency and accelerates innovation, ultimately boosting overall economic growth. Higher investment levels contribute to wage growth and improved living standards.

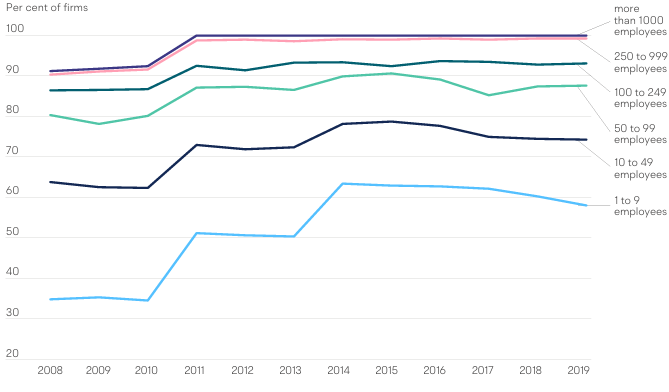

- The UK has historically lagged behind its G7 counterparts in business investment, with economic growth slowing significantly after the Global Financial Crisis. This persistent underinvestment has limited long-term economic competitiveness.

- A lack of capital investment is a key factor behind the UK’s productivity gap with countries like France and Germany. Businesses that invest more in capital assets and technology tend to achieve higher productivity and long-term sustainability.

- Smaller businesses are less likely to invest and typically do so at lower levels compared to larger firms. Limited access to capital and investor uncertainty makes it harder for small businesses to fund growth, innovation and productivity improvements.

- Small businesses often face higher borrowing costs and restricted access to finance due to perceived risks and lower availability of financial data. These barriers reduce investment capacity, slowing business expansion and limiting broader economic benefits.

3. Finance markets are evolving to reach entrepreneurs from different backgrounds and in more places.

- Since its founding in 2014, the British Business Bank has worked to improve access to finance and diversity funding options for smaller businesses. As we reported in last year’s Small Business Finance Markets report, UK small businesses have more finance choices than ever, supporting greater investment opportunities.

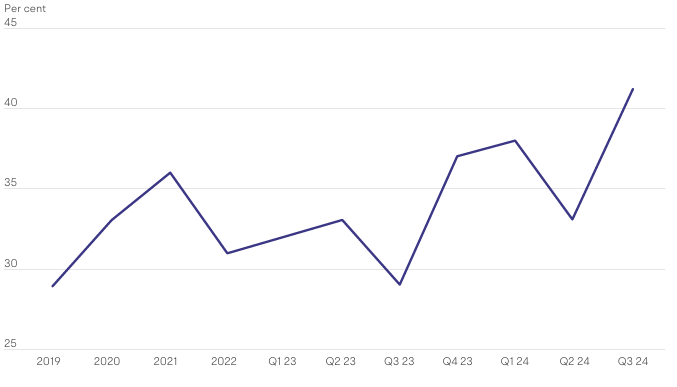

- While finance availability has improved, willingness to use external finance fluctuated in 2024, dropping to 33% in Q2 before rebounding to 41% in Q3. Many small businesses still rely on a single provider, with fewer than 40% considering multiple options.

- Ethnic minority-led businesses show higher willingness to use finance but face greater discouragement from applying. Geographic disparities also persist, with entrepreneurs in deprived areas struggling due to low awareness of finance options.

- To tackle regional and social disparities, the Community ENABLE Funding (CEF) programme was launched, increasing funding for social impact lenders that support underserved businesses across the UK’s nations and regions.

- The growing variety of finance options enables small businesses to find funding tailored to their needs, strengthening business investment, innovation and economic growth in the long term.

4. More investment is needed in the UK’s fastest growing and most innovative companies

- Innovative businesses play a great role in driving productivity, improving living standards and strengthening the UK’s global competitiveness in emerging industries. Many also contribute to tackling societal challenges such as the transition to net zero and global health.

- The British Business Bank provides targeted support for early and late-stage equity investment as well as private debt, ensuring innovative businesses can access the funding needed for growth and development.

- To further boost innovation funding, the British Growth Partnership is being developed (subject to regulatory approval) to attract pension funds and institutional investors into venture capital and high-growth businesses, enhancing long-term investment in UK innovation.

Get in contact

If you would like to meet to discuss the British Business Bank’s work backing innovation and breaking down barriers to small business finance, please contact us below:

Public Affairs email us