Report and publications

Our Small Business Equity Tracker 2019 (.pdf - 1.19 MB) report provides a unique, in depth picture of equity finance for smaller businesses. It is intended not only to inform the development of the Bank’s own strategy, but also to inform wider developments in both the market and government policy.

This is the fifth edition of the report the Bank has published since 2015.

Key findings:

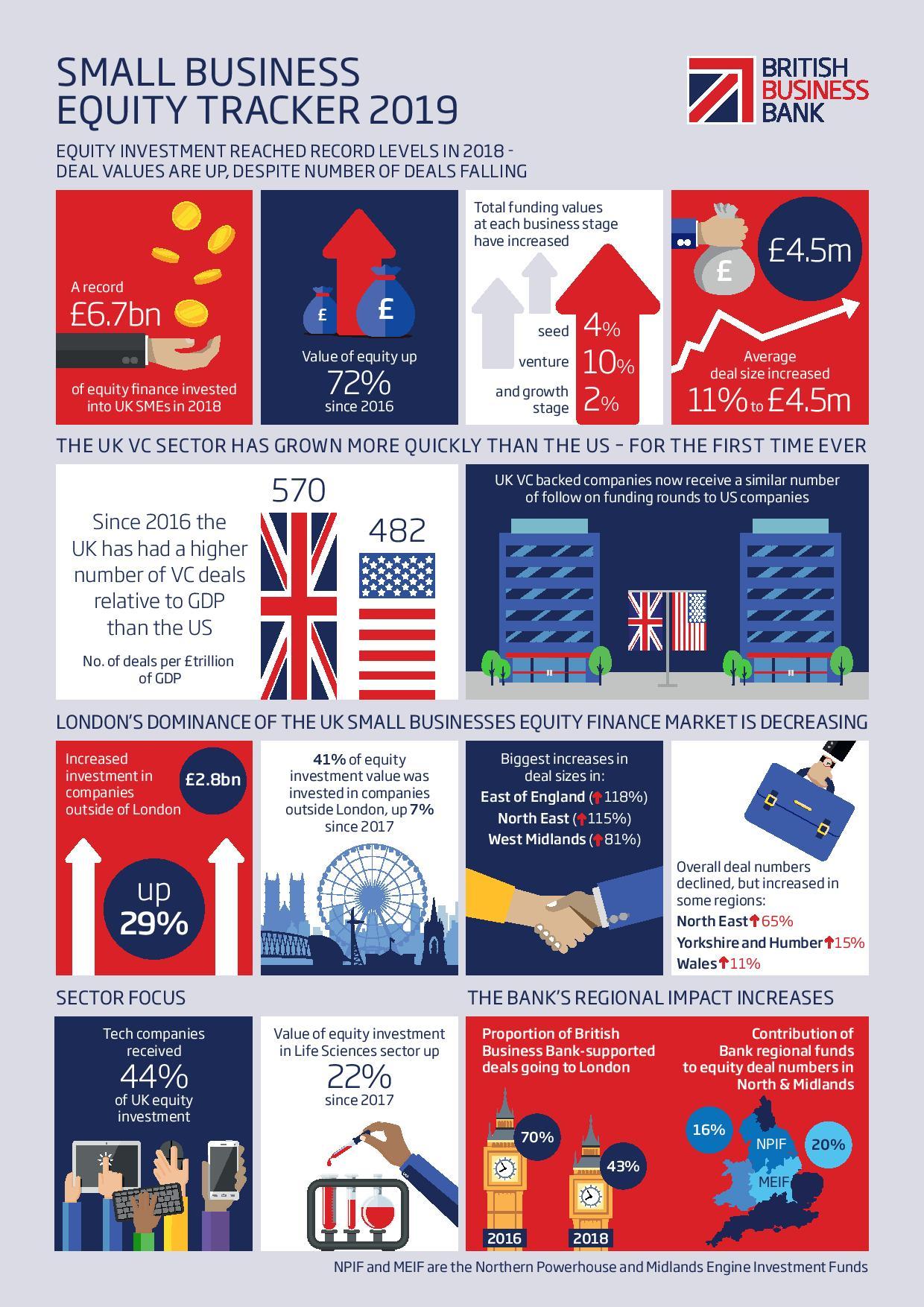

- The UK equity finance market is strong. Equity investment reached a record £6.7bn in 2018 – up 72% in two years and the second successive year of a total over £6bn. Deal values are up 5%, despite number of deals falling 6% compared to 2017.

- The UK VC sector has grown more quickly than the US over the last decade. Since 2016, the UK has had a higher number of VC deals relative to GDP than the US, (UK had 570 VC deals per £trn of GDP, 18% higher than the US which had 482 deals).

- London’s dominance as the centre of the UK’s equity market is waning. There has been increased investment in companies outside of London, up 29% (£616m) in 2018, driven by larger deal sizes. The East of England, North East and West Midlands are three regions driving this increase, with equity investment increasing by 118%, 115% and 81% respectively. Several UK regions also saw large increases in the number of deals – up by 65% in the North East, 15% in Yorkshire and Humber and 11% in Wales.

- The UK tech sector remains the focus for equity investors, with 44% of investment going to tech companies. Equity investment in tech businesses increased by 24% in 2018 with £3.0bn invested, the highest amount to date, mirroring wider equity market trends.

- British Business Bank programmes are estimated to have supported 9% of UK equity deals between 2016 and 2018, forming 13% of the overall invested equity amount. The Bank’s Midlands Engine Investment Fund (MEIF) and the Northern Powerhouse Investment Fund (NPIF) contributed 20% and 16% of equity deals in the Midlands and North in 2018 respectively. Meanwhile, the concentration of deals in London completed by Bank supported funds has reduced from 70% in 2016 to 43% in 2018.

- Low talent diversity, lack of professional development and barriers to entry may hinder the development of the next generation of senior venture capitalists.

Small Business Equity Tracker Infographic 2019

Small Business Equity Tracker 2019 Report

Our Small Business Equity Tracker 2019 report provides a unique, in depth picture of equity finance for smaller businesses.