Report and publications

Our Small Business Finance Markets 2017/18 report highlights a continued and welcome growth in finance flow to smaller business outside of traditional bank lending products.

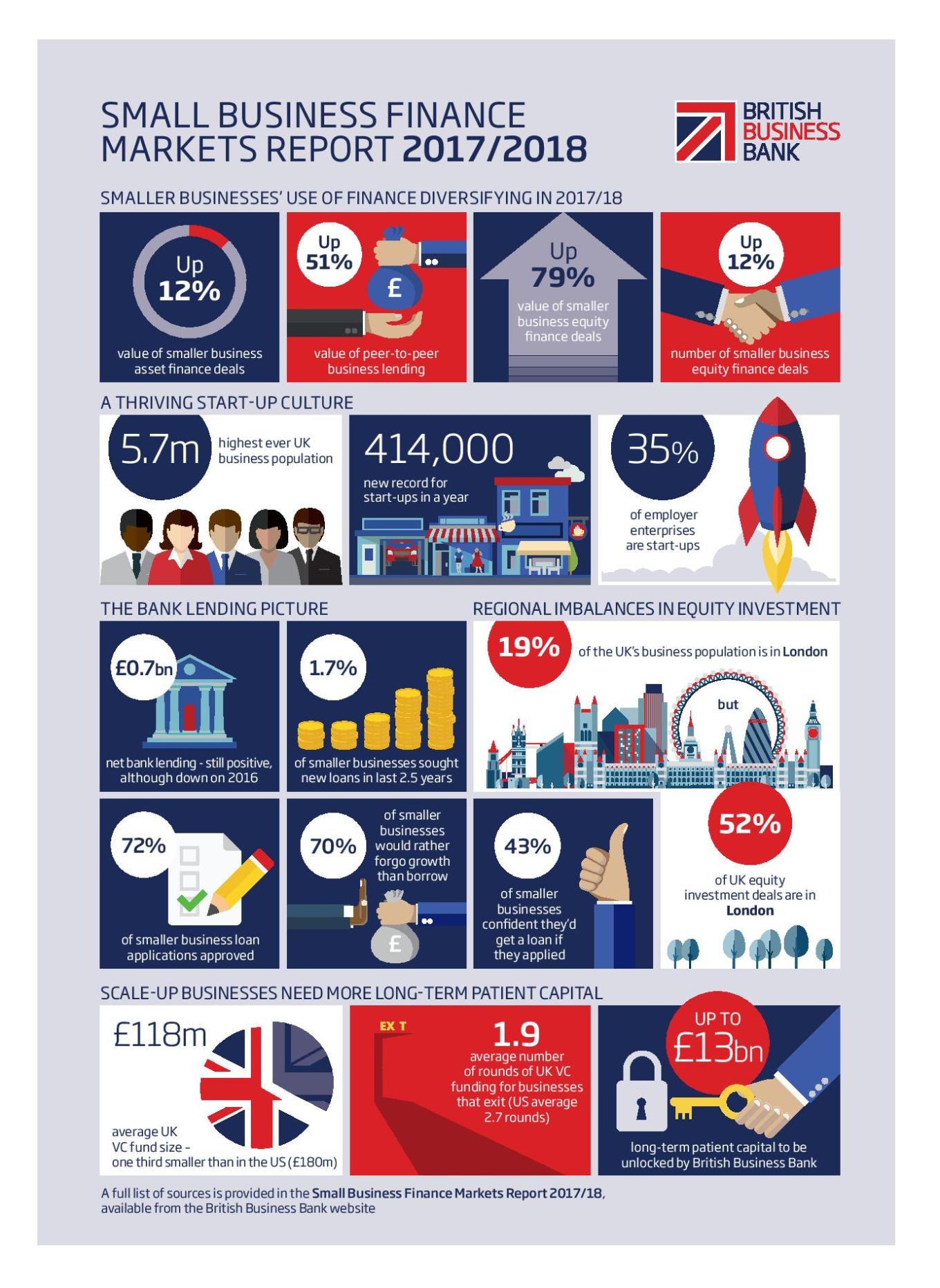

The value of equity investment (up 79% in 2017), asset finance (up 12%) and peer-to-peer business lending (up 51%) used by smaller businesses all showed significant growth in 2017, while net bank lending remained relatively flat.

That smaller businesses are using an increased range of finance options is relevant to two of the British Business Bank’s key objectives: to increase the diversity of supply by supporting new finance market entrants and innovative funding models; and to build smaller businesses’ confidence and awareness of their finance options, including through our popular Business Finance Guide, co-published with the ICAEW.

Although traditional banks are still the predominant source of finance, smaller businesses are considering and using an increased range of finance options to meet their funding needs. Matching smaller businesses with appropriate finance options will ultimately help them, and the UK economy, develop more successfully.

Taking account of these market developments, the British Business Bank will continue to focus on three broad areas to support smaller businesses’ ambitions and raise the growth potential of the UK economy:

- Supporting scale-ups: Through helping small businesses with the potential to scale-up, and who are scaling up, to obtain the growth finance they need and ensuring that they are aware of and understand the finance options available to them. This includes the development of our new £2.5bn Patient Capital entity which will be incubated within the Bank to co-invest commercially alongside private sector investors into venture and growth capital funds.

- Closing regional imbalances: Making sure that finance reaches smaller businesses across all regions of the UK economy to deliver widespread growth. To address the regional imbalance in equity finance, the 2017 Autumn Budget announced that the British Business Bank will shortly launch a commercial investment programme to support developing clusters of business angels outside of London.

- Raising awareness: Supporting policy goals, such as those set out in the Competition and Markets Authority Retail Banking Market Investigation, by improving information in the market and links between smaller businesses and finance providers so that businesses get the finance that best meets their needs. In 2018 the British Business Bank is implementing a new targeted information strategy. This new ‘targeted approach’ is intended to complement the Bank’s ongoing ‘whole of market’ activities which provides finance information aimed at all smaller businesses.

The British Business Bank 2017 Business Finance Survey

Evidence from our annual survey, undertaken by Ipsos MORI for the British Business Bank, is used extensively in the Small Business Finance Markets Report.

The survey includes new data on the awareness and use of finance by smaller businesses, as well as information of the growth plans of those businesses. Awareness of finance products amongst SMEs is plateauing, but shopping around when they have a finance need is rising, with fewer considering just one provider.

The survey conducted in the Autumn of 2017, includes new questions on trade credit, an important source of finance used by more than half of SMEs. Finally, the survey results highlight that majority of SMEs expect no impact from the UK leaving the EU and that have neither made nor expect to make changes as a result of leaving the EU.

Small Business Finance Markets 2017/18 Report

Our Small Business Finance Markets 2017/18 report highlights a continued and welcome growth in finance flow to smaller business outside of traditional bank lending products.