Report and publications

This quarterly Markets Update does not attempt to attempt to assess the full impact of Covid-19 on SME finance markets, but is made available as a regular update of key data contained in the Small Business Finance Markets 2019/20 report for the period from January to March, where available. Early signs are the Covid-19 pandemic will have a major negative impact on the UK economy that is likely to be worse than the financial crisis. Read footnote text 1

-

Return to footnote location

1

This update contains data available up until 30 April 2020

Small business confidence in the UK has fallen sharply to a record low amid the Covid-19 outbreak

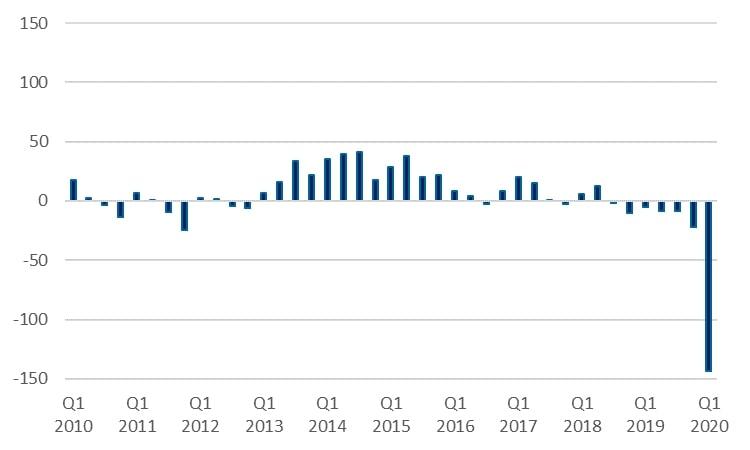

Small business confidence about their prospects for the coming three months weakened significantly as the pandemic escalated in the UK. The FSB Voice of Small Business survey for Q1 2020 showed the confidence index fell to -143.4, the lowest since it began in 2010. Also, the decline from -21.6 in Q4 2019 was the largest on record. Please note that the survey was conducted 13-23 March, which indicates it captures the initial response of small businesses to the outbreak but not the government support schemes coming into effect, e.g. the Coronavirus Business Interruption Loan Scheme opened for applications on 23 March.

Small business confidence index

Similarly, the business optimism index in the CBI Industrial Trends survey for the three months to April (which was conducted 25 March-14 April and covers manufacturing firms of all sizes) fell to -87 from +23 in the three months to January. This was the largest fall since the survey began in 1958. Previously, the index had risen to a two-year high in the three months to January. A probable explanation is that the general election result in December ended uncertainty as to whether the UK would leave the EU in January this year.

The UK economy is forecast to contract sharply in 2020

Real GDP rose 0.1% in the three months to February compared to the previous equivalent period, according to the Office of National Statistics. The only sector that contributed to the growth was services. The Covid-19 outbreak did not escalate in the UK until March, but the February data showed small negative impacts on certain industries such as travel agents and tour operators, and weaker exports of manufactured transport equipment to China.

The ONS data also showed real GDP fell 0.1% in February compared to the previous month. However, it is worth treating the monthly GDP data with caution because it can be subject to significant revisions.

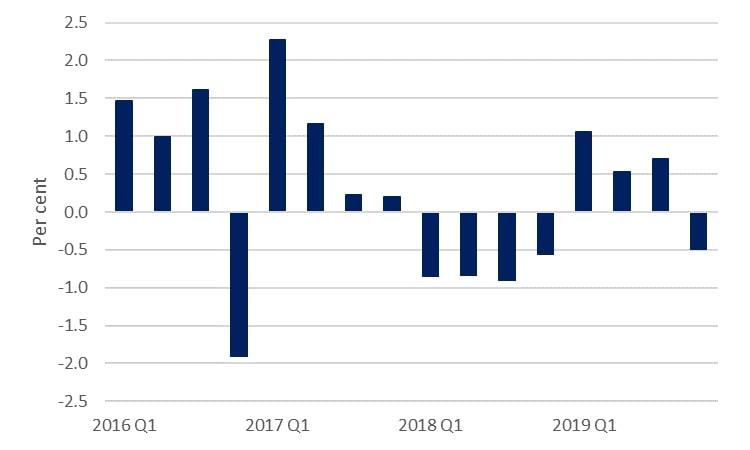

Business investment declined 0.5% in Q4 2019 compared to the previous quarter, according to the ONS. This was the first fall in four quarters. By type of asset, the main drags were from declines in investment in information and communication technology equipment, other machinery, and equipment.

Business investment, quarterly change

Key surveys indicate that the UK economy and business investment have contracted sharply amid the pandemic. The flash composite (manufacturing and services) purchasing managers index fell to 12.9 in April, the lowest since it began in 1996. Please note that a PMI of below 50 indicates a contraction in private sector activity.

Similarly, the Bank of England’s Agents summary of business conditions for Q1 2020 (which focused on the first three weeks of March) noted that businesses in sectors that were most impacted by Covid-19 (particularly those in retail, leisure, travel and hospitality) have put investment plans on hold to preserve their cash buffers. The CBI Trends survey for the three months to April also showed that spending plans for investment in buildings and plant & machinery in the next year fell to a record low.

Official forecasts suggest that the UK economy will contract sharply in 2020. The International Monetary Fund recently downgraded its forecast of UK real GDP to a fall of 6.5% (revised from a rise of 1%). In mid-April the Office for Budget Responsibility released an economic scenario on the potential impact of Covid-19 on the UK economy. In the scenario, the economy contracts by 13% in 2020. The IMF forecast and OBR scenario both assume that the outbreak fades in the second half of 2020, which allows for a gradual lifting of containment measures. Please note that the contraction of the UK economy in both the IMF forecast and OBR scenario are larger than those during the financial crisis. In 2008 and 2009, UK real GDP fell by 0.5% and 4.2% respectively.

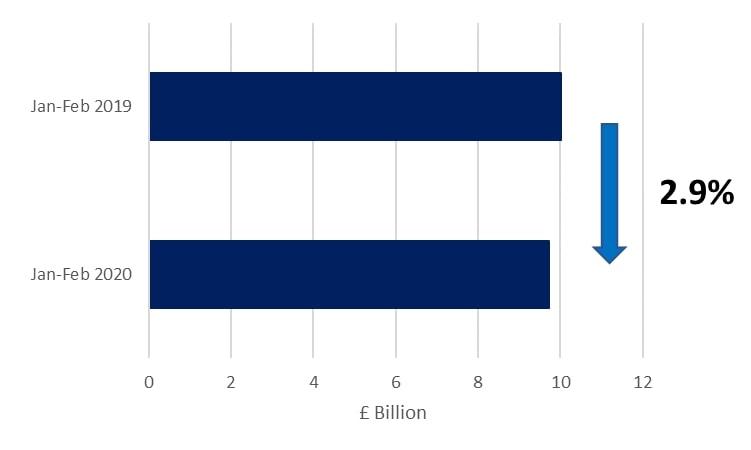

Gross bank lending weakened in the first two months of 2020, but our market contacts have subsequently seen a very large rise in demand for loans

According to the BoE Bankstats data, gross bank lending to SMEs in the first two months of this year was lower than in the same period of 2019. Gross bank lending (which includes term loans and credit cards but excludes overdrafts) totalled £9.73 billion seasonally adjusted in 2020-to-date. This was down by 2.9% from the corresponding period of last year. January and February were before the outbreak escalated in the UK.

Gross bank lending (excluding overdrafts) to smaller businesses

In January, gross bank lending rose 2% (s.a.) compared to the previous month. This is consistent with the British Business Bank’s market contacts reporting a pickup in the demand for bank loans shortly after the election in December. It is also in line with the improved confidence seen in the CBI Trends survey for the three months to January. However, in February, gross bank lending fell back slightly (s.a.) month-on-month. This may have been due to some SMEs reassessing their finance needs following the UK leaving the EU rather than the impact of the early stages of Covid-19.

However, the British Business Bank’s market contacts have subsequently reported a very large rise in the demand for bank loans, particularly through CBILS, in March and into April. There are signs that this will continue in coming months. The BoE Credit Conditions Survey for Q1 2020 (conducted March 2-20) showed that a net 65% of lenders expect the demand from small businesses for loans in the next three months to be higher. This was the highest net balance since the survey began in 2007.

In relation to credit conditions, the BoE Agents summary for Q1 reported that the availability of credit tightened for SMEs, and across an increasing range of sectors. It also noted that some banks have imposed more stringent lending conditions on new borrowers across all sectors, taken longer to approve loans due to the high volume of applications, and become more reluctant to renew revolving credit facilities. However, the BoE Credit Conditions Survey for Q1 showed that the availability of credit to small businesses and medium-sized private non-financial corporations in the past three months was broadly unchanged.

The conflicting pictures on credit availability highlight the differences between the two reports. First, the Agents Summary reflects the views of businesses while the Credit Conditions Survey captures those of lenders. Second, they cover different time periods. The Summary is a snapshot of the first three weeks of March, ie before the government support schemes came into effect. In contrast, the Survey covered the past three months.

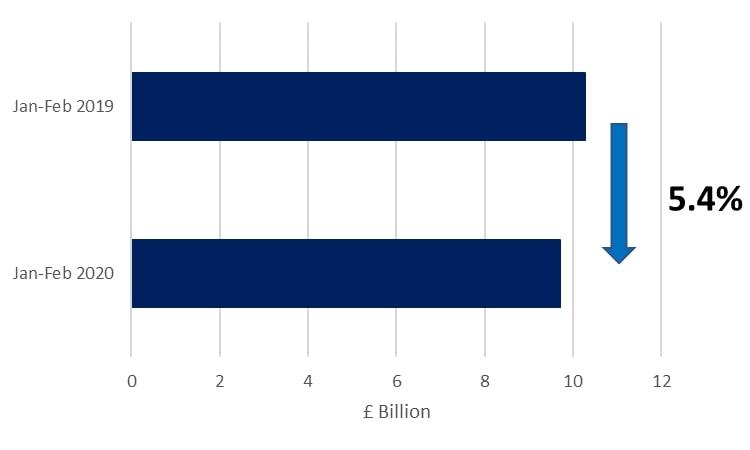

The total value of SME loan repayments in the first two months of 2020 was, like gross bank lending, lower than in the same period of last year. Repayments in 2020-to-date totalled £9.71 billion seasonally adjusted, down 5.4%.

Loan repayments by smaller businesses

A possible explanation for the lower repayments is that some SMEs paid down debt in 2018 to strengthen their balance sheets ahead of the original March 2019 Brexit date. Another could be some smaller businesses became more concerned about future cash flow and wanted to preserve their cash balances. This is supported by UK Finance data for the seven largest UK banks showing that the deposits held by SMEs rose in Q4 2019 to £203.4 billion, the highest since the data series began in 2011. It’s also possible that the lower level of repayments was due to some SMEs seeking to preserve access to their loan facilities.

Gross bank lending to SMEs in 2020-to-date exceeded loan repayments, resulting in positive net lending of £18 million. This compares to negative lending of £251 million in the same period of 2019.

Lower turnover due to Covid-19 has caused severe cash flow difficulties for many businesses, increasing the demand for working capital finance

Key business surveys indicate that the pandemic has had a major adverse impact on the turnover of many businesses. The third wave of the ONS Business Impact of Covid-19 Survey (conducted 20-26 April on the period 6-19 April) reported that 76% of firms were continuing to trade. Of these, 57% said their turnover had decreased in some way. Furthermore, 24% indicated that their turnover had decreased by more than half the normal level. This signals that the cash flow of many businesses is under major pressure.

Separate surveys report that the cash reserves held by most businesses are relatively limited. The fifth weekly British Chambers of Commerce Coronavirus Business Impact Tracker (conducted 22-24 April) showed that 56% of businesses have three months in cash reserve or less. This was broadly unchanged from previous weeks.

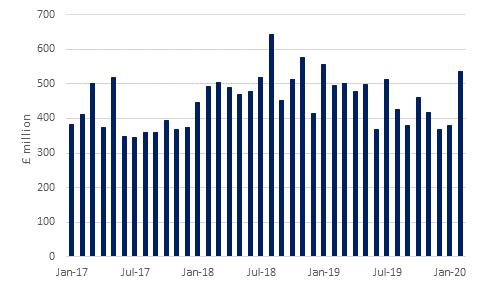

There are signs that the major pressure on cash flow has increased the demand for finance that can be used as working capital. The BoE Agents Summary noted a sharp rise in the demand for cashflow credit facilities, and businesses fully drawing down on existing facilities. The British Business Bank’s market contacts also recently reported an increase in demand for working capital and funding facilities of a relatively low value, eg below £50,000. In addition, UK Finance data shows that there was a sharp rise in the value of overdrafts to SMEs approved or increased each month in February. The value increased to £536 million, the highest in more than a year and up more than 40% from January. A probable explanation for the sharp rise is that some SMEs took precautionary action to support their working capital in anticipation of the Covid-19 outbreak escalating in the UK.

Value of overdraft facilities approved or increased each month

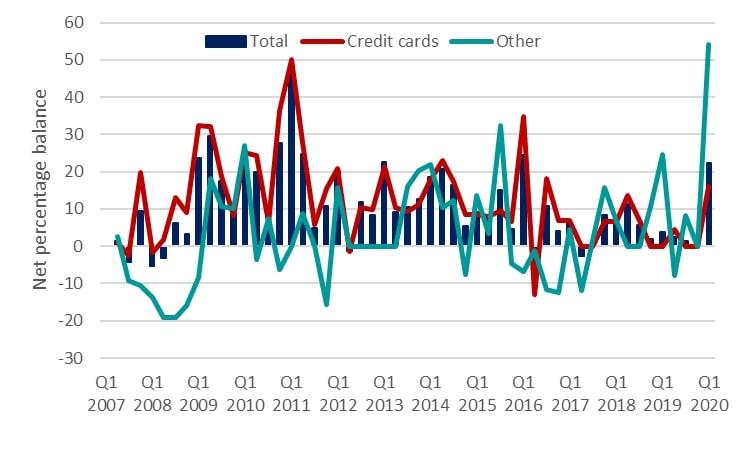

The BoE Credit Conditions Survey for Q1 suggests that the recent increase in demand for working capital will continue in the coming months. A net 22% of lenders expect the demand for total unsecured lending from small businesses in the next three months to be higher. This is a four-year high. The breakdown showed that lenders expect this to be largely driven by the demand for unsecured lending excluding credit cards (which includes overdrafts, lines of credit, invoice finance and asset finance).

Demand from small businesses for unsecured lending in the next 3 months

Equity investment in the UK SMEs reached a record high in 2019, but it’s too soon to assess the impact of Covid-19

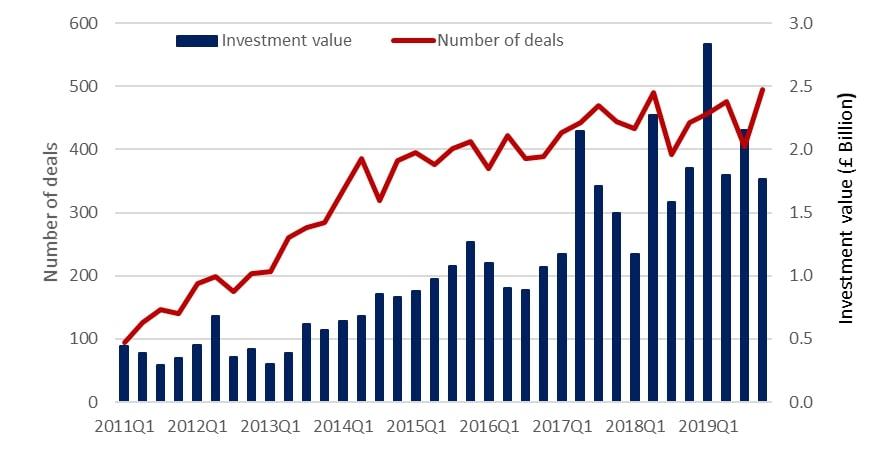

Data from Beauhurst shows that there was £8.5 billion of equity investment in UK SMEs last year. This was a record high and up 24% from 2018. The main drivers were at the growth stage, in terms of both the number and average size of deals. Around £5.3 billion of equity investment went to growth stage SMEs, up 39% from 2018. Similarly, investment in venture stage rose by 9%. In contrast, investment in seed stage fell by 1%.

In Q4 2019, £1.8 billion of equity was invested in UK SMEs. This was down 18% from the previous quarter but at a similar level to Q2.

There were 1,832 announced UK SME equity deals in 2019. This was 4% higher than in the previous year. The deal numbers for growth stage rose 11%, while those for venture stage were up 3%. Seed-stage deal numbers climbed 1%, recovering slightly after a weaker 2018 but still below their peak in 2017.

In Q4 2019, there were 495 deals. This was 25% higher than in the previous quarter.

SME equity investment values and number of deals by quarter

It’s too soon to assess the impact of the Covid-19 outbreak on the UK equity ecosystem due to the normal time delays that occur between equity investors making deals and announcing them. Beauhurst in early April published their numbers for Q1 2020 (which includes businesses of all sizes and so are not directly comparable to the British Business Bank numbers for SMEs).

Beauhurst identify that “flows of equity investment have taken a hit over the past few weeks” but it will take time “for the whole picture to come into focus”. They report investment values were higher in Q1 2020 than in Q3 and Q4 last year. However, there were only 344 announced equity deals in Q1 2020, the lowest number since Q3 2014. Beauhurst also note that March was particularly weak, coinciding with the escalation of the pandemic in the UK, and there could also be delays in investors reporting their deals. This indicates that both deal and investment numbers are likely to be significantly impacted from Q2 2020 onward.

A separate recent Beauhurst report (.pdf, 1.94kb - opens in new window) on the business impact of Covid-19 found that larger companies are more at risk than their smaller counterparts, both when looking at turnover and employment. Among SMEs, those in the 100-249 employment bracket are by far the most affected. Please note that these indicators relate to how the product/service market has been affected by the Covid-19 restrictions, eg closure of shop front. However, they do not show which companies are under financial stress per se or which need equity funding.

A recent PitchBook report also predicts “a decline in total venture transaction volume over the next few quarters” in the US venture capital market, which is also likely to be true for its UK counterpart. The report acknowledges “The lack of in-person meetings slows down sourcing and due diligence” and there will be a slowdown in new deal activity as VCs reserve capital for their existing most promising portfolio companies. The British Business Bank will continue to monitor these market conditions very carefully.

The growth of SME asset finance and marketplace finance and marketplace business lending weakened before the outbreak escalated in the UK

Total SME asset finance new business (largely leasing and hire purchase) was £2.6 billion in the first two months of 2020, according to our estimates based on data from the Finance and Leasing Association (FLA). This was 4.9% lower than in the same period of last year.

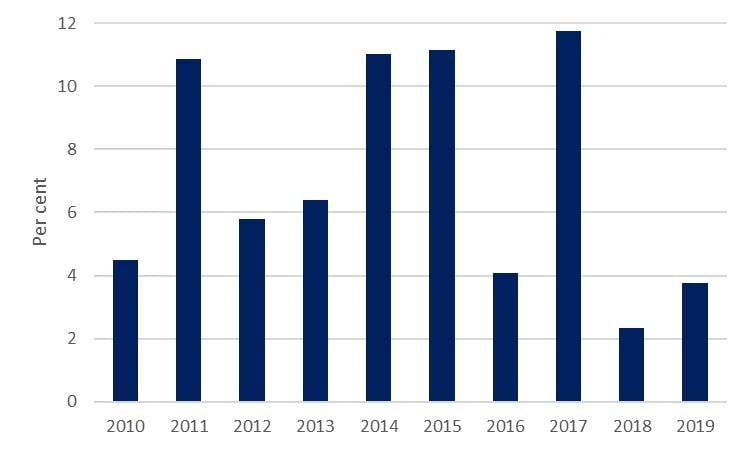

The growth of SME asset finance has trended weaker since May 2019. Last year saw the unique dynamic of Brexit dates seemingly impacting the SME asset finance market. 2019 got off to a strong start, with double-digit growth in the three of the first four months. This may have resulted from a combination of factors such as investment being brought forward ahead of a period of uncertainty and expected tighter credit conditions, and increased demand for new finance for plant and machinery by some SMEs that were building up their inventories of raw materials and finished goods.

In 2019 SME asset finance totalled £20.1 billion. This was up 4% from the previous year and occurred despite weak business investment. Such growth was stronger than in 2018 (2%) but below the double-digit rates in the middle of the decade, eg 2017 (12%) and 2015 and 2014 (both 11%).

Growth of SME asset finance

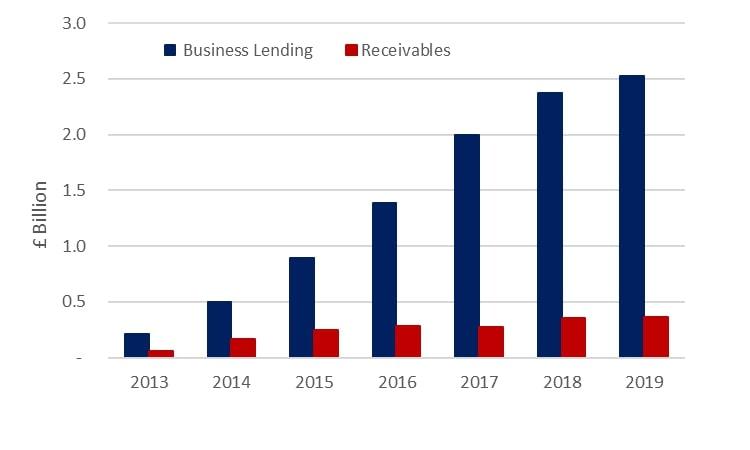

Marketplace business lending was £2.5 billion in 2019. This was up 7% from the previous year and the highest level since records began in 2013. However, this pace of growth was much slower than in 2018 (19%) and the weakest on record.

By component, business lending was the largest, accounting for 42% of all marketplace lending. Property lending and consumer lending each accounted for 26%. Consumer lending fell compared to the previous year for the first time on record.

The value of receivables in 2019 was just over £360 million. This was up 1% from the previous year but well down from growth of 29% in 2018.

Marketplace business lending and receivables

Data Tables

Aggregate flow and stock of finance to smaller businesses, £ billions

The following table brings together the latest data available as at 30 April from multiple sources, to present a snapshot of the current values of various types of external finance – and the number of reported deals for equity investment – provided to UK smaller businesses.

Our 2019/20 Small Business Finance Markets (.pdf, 4.37mb - opens in new window) report looks at market developments in more detail including regional comparisons and deeper dives into the demand side.

| 2016 | 2017 | 2018 | 2019 | YTD 2020 | YTD change on previous year | ||

|---|---|---|---|---|---|---|---|

| Bank lending stock Source: BoE | Outstanding amount £bn | 166 | 165 | 166 | 168 | 167 (Feb) | +0.9% |

| Bank lending flows Source: BoE | Gross flows £bn (a) | 59 | 57 | 58 | 57 | 9.1 (Feb) | +4.1% |

| Other gross flows of SME finance | |||||||

| Private external equity investments Source: Beauhurst | Investment value £bn | 4.0 | 6.5 | 6.9 | 8.5 | NA | NA |

| No. of reported deals | 1566 | 1784 | 1758 | 1832 | NA | NA | |

| Asset finance flows £bn Source: FLA | 17.0 | 19.0 | 19.4 | 20.1 | 2.6 | -4.9% | |

| Marketplace business lending flows Source: Brismo and British Business Bank calculations | 1.4 | 2.0 | 2.4 | 2.5 | NA | NA | |

The information contained in this table should be viewed as indicative as data and definitions are not directly comparable across different sources. There can be some double counting across estimates in different parts of the table. Flows data are cumulative totals for the year or to the date stated. Non-seasonally adjusted.

(a) Data exclude overdrafts and covers loans in both sterling and foreign currency, expressed in sterling and not seasonally adjusted. Latest data available as at 30 April.

Small business confidence

The table below contains historical data for the FSB Small Business Index.

| 2017 | 2018 | 2019 | 2020 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 |

| 20 | 15 | 1.1 | -2.5 | 6 | 12.9 | -1.7 | 9.9 | -5 | -8.8 | -8.1 | -21.6 | -143.4 |